Introduction

Strategic management refers to formulation and execution of main initiatives as well as goals which are taken through top management of an organization on the behalf of firm's owner. It gives direction to business firm and includes particular objectives of firm, creating better plans and policies in order to design for accomplish all aims and allocating resources. Under this mention report discuss about the factors which offer most necessary opportunities to BP organisation and essential threats (Ackermann and Eden, 2011). Five force analysis on attract world steel industry will be discussed under this mention report. There is a need of selection of specific product of an organisation will be discussed under this assignment.

Increase Your Odds of Success With Our

- Scholastic academic documents

- Pocket friendly prices

- Assured reliability, authenticity & excellence

Task 1

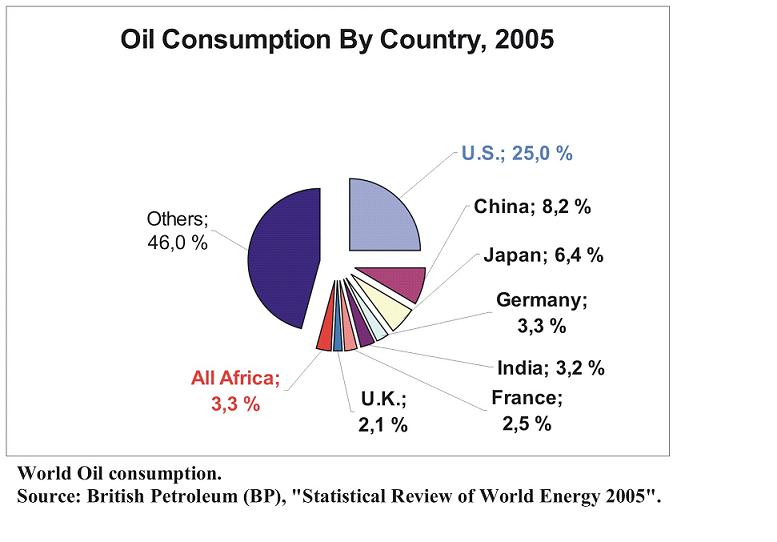

PESTEL analysis and important opportunities to BP and threats

BP is the largest gas and oil organisation which operates production, distribution right across an exploration, marketing and refining. In all over the world, there are almost 21000 service stations. PESTLE (Political, Environment, Social, Technological, Legal and Economical) Analysis is concerned as a PEST which is a marketing concept. It is a beneficial tool which is used through business firms in order to track environment in which they operate their business in order to make planning for launching a new product, project, etc. There is PESTLE Analysis of BP organisation given as below:

Political factors- It includes effect of rules as well as regulations of government on policies and operations of an organisation. BP is one of the multinational energy firm which targets global market (Barney and Hesterly, 2010).

Environmental factors- It is a necessary factor and in this harmful gases are emitted because of extracting, refining and also developing petroleum affect business environment in negative manner.

Social factors- View and choice of people are modifying and enhancing concerns over sustainability of future. Agreement of Kyoto of 1992 has been lead for carbon finance as well as trading of an emission is became legal need (David, 2011). This factor consists society age, culture related problems etc.

Technological factor- This is a beneficial external and environmental factors which operations affects British Petroleum. BP firm adopt new technology for resolving issues and this organisation has developed with better advancement in world.

Legal factor- Safety and health policies are regulated through government. Government of United Kingdom is concerned with health of people related with oil industry (Evans, Stonehouse and Campbell, 2012). It is helpful in protect personal health of employees.

Economical factor- An economy of several nation which rely on BP is underpinned through supply of its energy.

Opportunities

There was a better opportunity to BP business firm aligned with Rosneft in a partnership and its market share was 18%.There are some of the better opportunities to BP to follow all rules and policies which are developed through UK government. There is a need to BP organisation to develop new legislations and ruled which are related to safety of workers in order to run business operations in an effective manner. Extractive technologies led the cost of natural gas in USA to decline 30% among 2011 and 2013 year. In new technologies consist exploitation of fracking and fire ice, gas extraction of the gas through fracturing an underground retain order to produce the 'shale gas'. Firm should develop the health policies for workers so that they can work without fear of accidents. On the basis of report of Forbes magazine that economic development among year 2012 and 2020 of 7% per annum for the China, around 1% for Europe and 2% for United States.

Threats

Under this, main risks are included in production and exploring gas as well as oil activities. In the year 2010, Deep water Horizon oil of BP rig exploded which caused the deaths of 11 people as well as oil slick in Mexico by covering 180000 km. From gas exploring, 11 people were dead. Falling in car usage in several European Economies. Under this Fracking is responsible to pollute the supplies of local water and trigger the little earthquakes. On the basis of Cornell University,a round 8% of gas extracted through release of fracking directly to atmosphere. The policies and legislations of every country different from each other so it is difficult to conduct business in different countries. Falling in car usage in several European Economies. The cost of oil peaked about $120 barrel in year 2008 before dropping around $30 as recession hold in year 2009 and also recovering around $100 in year 2012.

Task 2

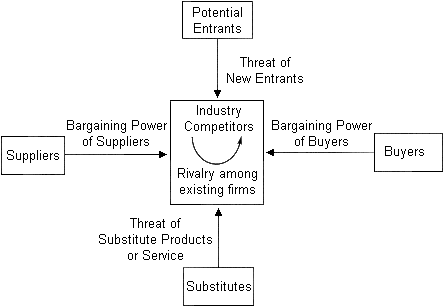

Porter’s Five Force Analysis

From long time period, industry of steel was seen to be unprofitable as well as static because of high competition level (Freeman, 2010). Five Forces analysis tool is helpful in examining the business competition. It draws from economies of industrial firm in order to derive the five forces which identifying attractiveness and competitive intensity of industry in context to gain more profit. Under this, Model of Porter's Five Forces mentions below as above:

Threat of new Entrant: In the steel industry, there are large number of organisations which are working in this sector and from this, firm faces high competition. On the basis of case study, in front of several steel organisations, China became a main force in all over the world. There were main competitors of China was Tata and Mittal. The producers of China enhanced their capacity more than 7 times but there was a fear to China regarding demand of domestic steel that went down in comparison to global market.

Bargaining power of buyer: Consumer's bargaining power is more at the time of buying goods in bulk. If at market place, there will be large number of steel firms and buyers can switch firm. Main consumers of the steel are international car producers.

Bargaining power of the Supplier: They are necessary factors which give raw materials to firms for producing better quality of goods. According to the given case study, Iron core is the main suppler who provides raw materials to steel producers.

Threat of Substitutes: It refers to those goods or services which can be replaced instead of other basic products and satisfy the same need (Hair and et. al., 2012). In case at market place, there are more substitutes are available then the competition will be enhanced. Like there is a more competition among the Tinto, BHP Billiton and Vale.

Competitive Rivalry: Under this, it is necessary to regard competitors which are present in the business environment. China is the main player in steel industry and its competitors are Mittal and Tata organisations.

Conclusion

It has been concluded from above given report that porters five forces are helpful in giving competitive advantage to business. Under this given report Porter's five forces of Steel industry studied under this mention report.

Task 3

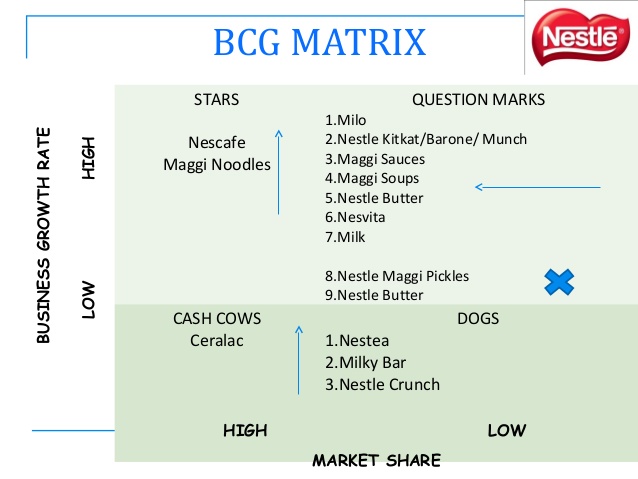

a) Growth/market share using BCG Matrix

BCG matrix is one of the most long-lasting and common methods of conceiving of balance portfolio of business. It uses criteria of market growth and market share for identifying balance and attractiveness of business portfolio. In addition to this, there is a requirement to be balanced with portfolio, so there are some of the busienss which are low growth making surplus to finance investment requirement of more- growth busiensses. Under this, Nestle firm is selected for BCG matrix. This organisation manufactures as well as exports beverage and food items for consumers in all over the world. The main products in which Nestle Organisation deals are breakfast cereals, chocolate, bottled water, coffee, drinks, foods items, confectionery products and many others (Keupp, Palmié and Gassmann, 2012). This organisation deals in around 29 brands and sales is approx $1 billion. In they large competition NESTLE firm growing day by day. The market share of Nestle is more in market and this firm provide its goods in all over the world. On the other hand, BCG (Boston Consulting Group) is prepared to assess with strategic planning for long term and regard growth related opportunities through reviewing its products portfolio. Nestle business firm used BCG matrix in order to determine the sell off of a particular brand. BCG matrix is helpful in know about the market share or growth of firm in an effective as well as better manner. Under this particular product which is taken for BCG matrix is Maggi. BCG matrix of NESTLE firm given below as above:

Dog- This business unit is with the portfolio of low market share in develop markets. They neither earn cash nor need more fund. They can be use up and cash drain a disproportionate amount of the firm resources as well as managerial time. From the minimum market share, these kinds of business firms face the cost limitation related issue ( Hodgkinson and Healey, 2011). In addition to this maggi faced more competition from Hakka noodles and Top Ramen. Profit level as well as market share of maggi goes down. It is only because of the poor sales rate in saturated market.

Question mark- This unit of business with portfolio which is in developed market, but this does not have the more market share. It is necessary to create some questions marks in to the stars, as the current starts become cash cows stage can decline in to the dogs. Under this, there is high growth rate and low market share. At the starting stage, the rate of failure is more and there was limited distribution of Maggi. There was high cost of production as well as more marketing (Poister, 2010). There is need to Magi 2-minute Noodles to more investment in context to capitalise on developing culinary segment but not provide the more return on investment in the portfolio of Nestle brand.

Stars- In this, Strategic business units with high growth market and high share. Star stage many be more spending must be yield enough profit to more this more in context to investment. in order to keep its growth, but high share of market In this time period, Maggie is at star stage where the market share is high as well as product growth. In addition to this, there are many competitors of Maggie but this product maintain its productivity and image because of its quality. Under this, sales of Maggi enhancing more and earning the healthy profits.

Cash cow- This business unit is with the low growth market and high share. Because of introducing the other noodle goods such as Top Ramen, Maggi noodles began to fall down. There is a need to less investment in order to generate more revenue which helps in enhancing profit level (Schilling, 2010). This factor is reinvested in to the Question mark and Star.

b) Potential problems with BCG matrix

BCG matrix was developed through Boston Consulting Group which is used by business firms in order to examine their strategic positions. For production business,. It is necessary to understand market place of goods. From this company can promote its goods in a better and proper manner. BCG matrix is helpful in evaluating performance level and growth of firm in a proper or systematic manner. BCG matrix provides advantages to business firm in a better manner. This kind of matrix has some advantages as well as problems. Some of the limitations which need to be evaluated in context to search improvement areas for earning more profit level. With the help of this productivity level of firm will be enhanced in a better manner. Growth share matrix of Boston Consulting Group uses competitive position and attractiveness in order to compare strategic position of various businesses. Simplicity of BCG matrix has some limitations and also usefulness (Ackermann and Eden, 2011). There is a common complication which is related with treatment of BCG matrix is minor. It is renowned tool for analysis of business portfolio. There are some of potential issues with BCG matrix given below as above:

Definitional vagueness- This can be complex to decide high or low growth and market share in specific conditions. Manager of Nestle company often to describe themselves as a s high market share through describing their market in specific narrow.

Capital market assumptions- Under this, business parent requires balanced portfolio to the finance investment from internal sources supposed that the capital may not enhanced in the external markets.

Other than these, there are some other disadvantages given below:

- This matrix classifies business as high and low but businesses can also be medium. This BCG matrix does not reflect its true nature.

- Relative market share as well as growth rate are not profitability indicators. This model overlooks as well as neglects other profitability indicators.

- It is not necessary that high share of market does not always tends to generate high profit. Under this, high cost is includes with large market share.

- In order to gain the more profit level, dogs stage can assess other businesses and sometimes they can earn more as comparison to other cash cow stage.

- In BCG matrix, there is an issue of getting data as well as information on market rate and share (Hodgkinson and Healey, 2011).

Conclusion

It has been concluded from above given report that strategic management helps in developing as well as implementation of aims at workplace. In this report studied regarding PESTLE Analysis of BP organisation and also their opportunities as well as threats. Opportunities are helpful in producing benefits to firm. Porter's five forces of Steel industry also discussed in present report. In this given report studied regarding BCG matrix of specific product of NESTLE organisation.

You may also like to read:

Set in Motion the Plan for Exemplary Grades with Our Extensive Academic Writing Services

Premium Assignment Services

References

- Ackermann, F. and Eden, C., 2011. Strategic management of stakeholders: Theory and practice.Long range planning.44(3). pp.179-196.

- Barney, J.B. and Hesterly, W.S., 2010.Strategic management and competitive advantage: Concepts. Prentice hall.

- David, F.R., 2011.Strategic management: Concepts and cases. Peaeson/Prentice Hall.

- Evans, N., Stonehouse, G. and Campbell, D., 2012.Strategic management for travel and tourism. Taylor & Francis.

- Freeman, R.E., 2010.Strategic management: A stakeholder approach. Cambridge university press.

- Hair, J.F. and et. al., 2012. The use of partial least squares structural equation modeling in strategic management research: a review of past practices and recommendations for future applications.Long range planning.45(5-6). pp.320-340.

- Hodgkinson, G.P. and Healey, M.P., 2011. Psychological foundations of dynamic capabilities: reflexion and reflection in strategic management.Strategic Management Journal.32(13). pp.1500-1516.

- Keupp, M.M., Palmié, M. and Gassmann, O., 2012. The strategic management of innovation: A systematic review and paths for future research.International Journal of Management Reviews.14(4). pp.367-390.

- Poister, T.H., 2010. The future of strategic planning in the public sector: Linking strategic management and performance.Public Administration Review.70(s1).

- Schilling, M.A., 2010.Strategic management of technological innovation. Tata McGraw-Hill Education.